Financial literacy for kids

Instill money management habits at an early age

How Tut works

Tut is an innovative app that teaches children financial literacy in a fun and interactive way. Through an Easy, Smart, and Secure mobile platform, parents can monitor and develop their children's money management skills

First step

Download Tut

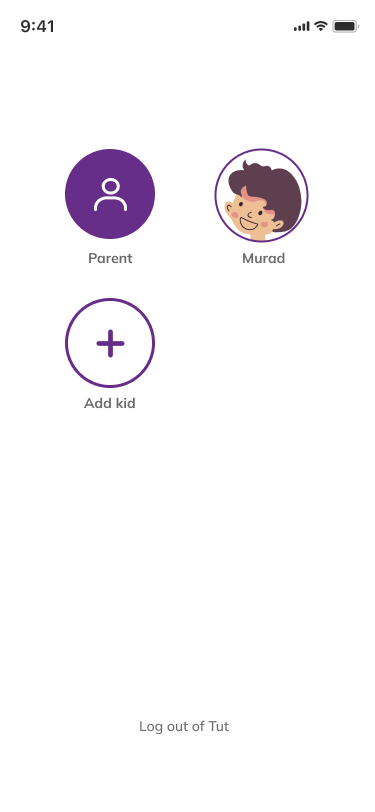

Second step

Add your children

Third step

Kids start to learn

Plans

Single child plan

Multi child plan

Our story

Our story

Tut is a gamified financial literacy app designed for kids. It helps kids learn the value of money through real-life tasks and interactive challenges.

Most financial literacy apps focus on selling financial products to families. Tut is different. It is a neutral, global platform built around “Tut money,” a simulated currency that mirrors real money without the risks. Families decide the value of Tut, so it works in every country, with every currency. In certain countries, we also plan to partner with financial institutions to provide real-money features and give families the choice between tut money and real money.

We created Tut with a vision to give every child a safe, engaging way to learn about money in the digital age.

Tut combines parental guidance with kid-friendly experiences in a way that is simple, fun, and scalable. Parents can manage kid profiles, assign tasks with rewards, and track their learning progress. Kids, in turn, can explore money through interactive features:

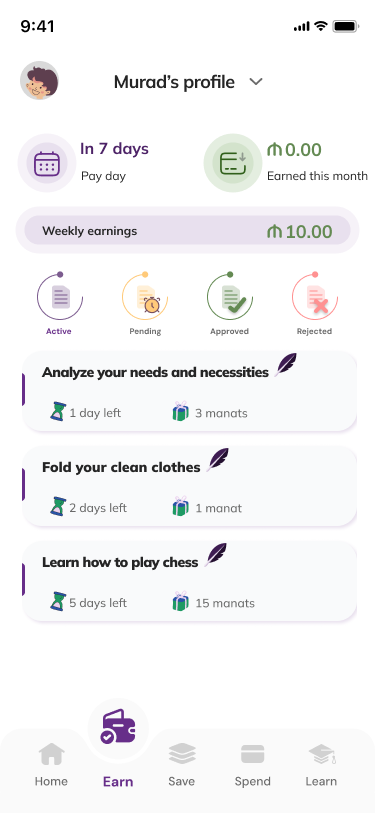

- Earn — view daily tasks, complete them and earn pocket money rewards.

- Save — set personalised savings goals, such as a bike, a smartwatch, or anything they dream of.

- Spend — track spending and manage a customizable digital card made just for kids.

- Learn — discover weekly topics with guided smart rules for a safe, AI-like learning experience, plus short quizzes to build confidence.

- Magic box — unlock daily surprises such as jokes, fun facts, and stickers that you they can stick on saving goals.

This balance of structure and play makes Tut more than just an app — it is a digital finance classroom that grows with your child’s learning while keeping parents in full control. With support for English and Russian (and more languages to come with community input), Tut is built to be accessible for families around the world — from Africa to Asia, Europe to the Americas.

Our mission is to make financial literacy universal and equip the next generation with the confidence and skills to thrive in a digital financial world.

Frequently asked questions

-

What age groups is Tut suitable for?

Tut is suitable for ages 4+ with simulated money, and for ages 7+ with real money.

-

Where does Tut work?

The simulated money version is available almost everywhere in the world. For real money features, we are partnering with banks to make them available in certain countries.

-

Is Tut paid?

Yes. The single-child plan costs $1.99/month (or $19.99/year), and the multi-child plan costs $5.99/month (or $59.99/year).

-

I am having trouble with the app, where can I get help?

You can report the issue to us through the Contact Us page below, or reach our support line directly from within the app.